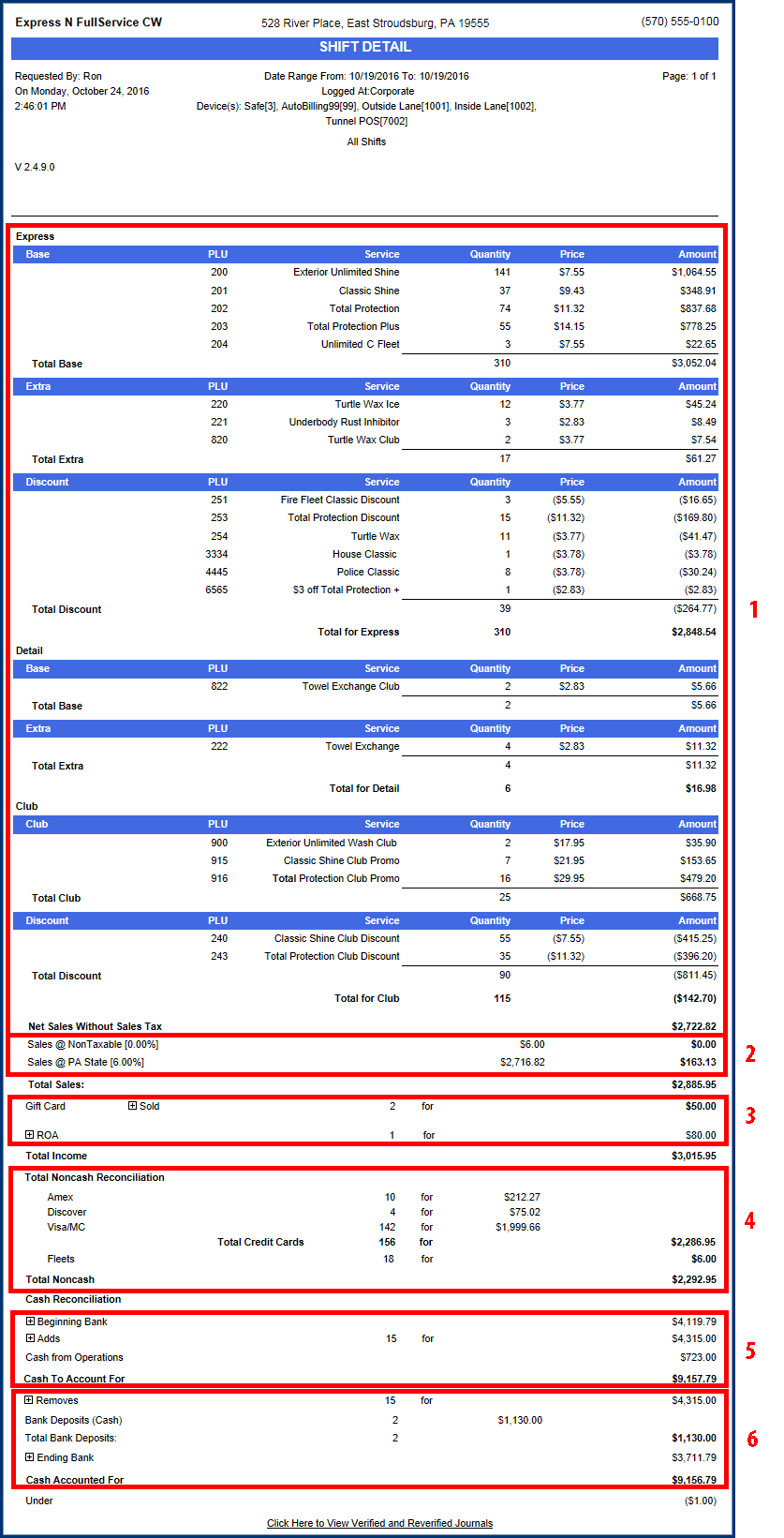

The following table describes the respective sections of the Shift Detail report below.

| 1 |

Net Sales Without Sales Tax (total sales before tax). |

| 2 |

Sales Tax (Example= Sales @ PA State Tax [6.00%]) based on taxable Net Sales multiplied by the associated tax rates. |

| 3 |

Total Income (All Monies received for the report date range including Gift Cards Sold, Received on Accounts (Fleets), Fund Raisers, and PLU discounts. This is before any Payouts, Removes, or Bank Deposits have been applied. |

| 4 |

Total Non-Cash Income includes the sum of all sales completed by credit cards, debit cards, fuel sales, Fleet accounts, gift cards, tokens, and External POS sales. |

| 5 |

Cash To Account for = Beginning Banks + Adds + Refunds Due + Cash & Checks from Operations. |

|

6

|

Cash Accounted for = Payouts + Removes + Bank Deposits + Ending Banks. |

NOTE: The Cash to Account For and Cash Accounted For should balance.

Shift Detail Report