A Sales Item can be a product, service, or discount sold at the car wash. Sales Items can be sold individually or grouped together in a package.

To add a Sales Item, follow these steps:

NOTE: If you create a sales item at the individual site, you can not sell the sales item at other locations. If you want to sell a sales item at other locations, you will need to add the Sales Item from Corporate. If you already created a Sales Item at the individual site, you cannot easily transfer it over to Corporate. You will need to log in to Corporate and add a new Sales Item.

- At WashConnect login, select either Corporate or the individual site.

- Select Configuration > Goods and Services > Sales Items.

- In the Profit Center box, select a profit center from the list where the Sales Item

will be sold and tracked in.

NOTE: Profit Centers are important for reporting purposes.

For more information, see Profit Centers.

- Click the Add button.

The Sales Item dialog box appears.

- In the PLU box, type a positive whole number.

Tip: For effective organization, it is recommended that you prepare an organized number system for sales item PLUs with your accountant. (NOTE: PLU# 900-999 are unavailable as the system uses those numbers to generate Club Service PLUs.)

-

In the Price box, type a Price before tax, and then press the Tab key or click in another box.

-

In the Name box, type the name of the sales item or service.

-

In the Type box, select one of the following:

- Base

- Extra

- Discount

- Discount Coupon

- Other

- Miscellaneous

-

In the Taxable box, make a selection from the list:

In the Taxable box, make a selection from the list:

- Always - Taxable

- Never - Taxable (default)

- Conditional - Taxable

- Force - Taxable

NOTES:

- When you enter a new Sales Item, the Taxable selection will always default to Never.

- If you change the Taxable selection to Always BEFORE entering a price, the calculation will be shown correctly as it is entered. If you enter the Price first and then change the Taxable selection, the calculations do not change on the fly, you must save to review the correct numbers.

- Item Rounding can be set up by ICS Technical Support for the rounding of Sales Items.

- When you begin the setup by entering the Price before changing the Taxable selection, the form calculates the tax based on the Never selection. i.e., if the service price entered $2.83 taxed at a rate of 0.00 causes the price of service to be rounded up to $2.85 to honor rounding by five cents.

-

In the Item Tax box, and total for the sales item will display as the price is entered.

NOTES:

- See Item Rounding for more information, if the price appears to be off by a few cents, Price Rounding could be turned on.

- Only the Gas Pump profit center allows three decimal places.

NOTE: PLUs for Coupon Codes can be 3- or 4-digits in length.

- In the Track Service box, click to select if sales item is set up to be trackable.

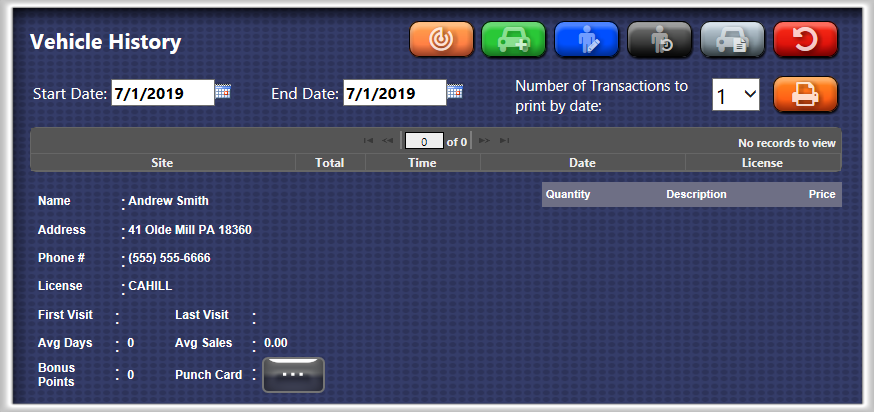

NOTE: When identifying a customer in the POS, you may select the Customer History button or the Vehicle History button to open the appropriate History form, and the Trackable Services button appears along the top of the form as shown below.

-

In the remaining fields, type any additional information available.

- Click the Save button.